does texas have inheritance tax 2021

Tax law is one of the most complex areas of the law. Impose estate taxes and six impose inheritance taxes.

What Is The Probate Process In Texas A Step By Step Guide

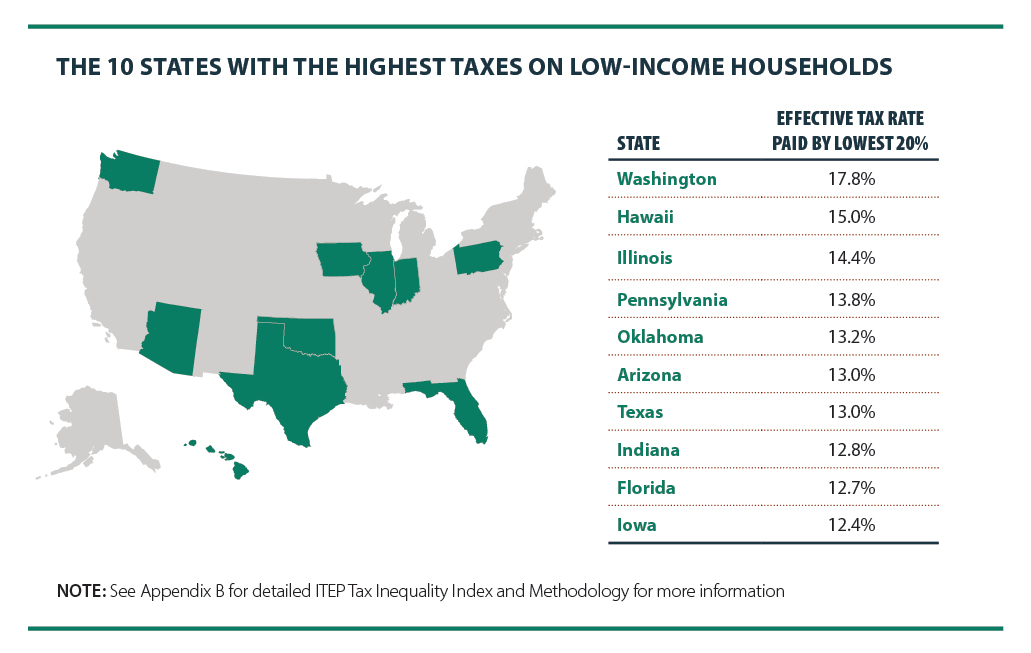

While Texas does not assess a.

. While in his twenties Bush flew warplanes in the Texas Air National. Notable Ranking Changes in this Years Index Arizona. Similar to an.

In 2021 rates started at 108 percent while the lowest rate in 2022 is 116 percent. Property Tax and Exemptions. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

The availability of legally recognized same-sex marriage in the United States expanded from one state Massachusetts in 2004 to all fifty states in 2015 through various court rulings state legislation and direct popular votes. Homeowners in New Hampshire end up paying the third-highest property tax rate in the country 189 percent the Tax Foundations estimates found while Texas isnt far behind at 16 percent. The United States the Soviet Union and Western European and East Asian countries in particular experienced unusually high and.

Virginia officially the Commonwealth of Virginia is a state in the Mid-Atlantic and Southeastern regions of the United States between the Atlantic Coast and the Appalachian MountainsThe geography and climate of the Commonwealth are shaped by the Blue Ridge Mountains and the Chesapeake Bay which provide habitat for much of its flora and faunaThe capital of the. The recent legislation the Tax Cuts and Jobs Acts TCJA the first major change to tax law since 1986 had many implications for business. Emphasizing pluralism cosmopolitanism cooperation civil and political rights bodily.

By March 19 2021 Trumps former personal lawyer Michael Cohen had met eight times with investigators for the Manhattan District. The analysis is ongoing. States each have separate marriage laws which must adhere to rulings by the Supreme Court of the United States that recognize marriage as a fundamental.

Wyoming w aɪ ˈ oʊ m ɪ ŋ is a state in the Mountain West subregion of the Western United StatesIt is bordered by Montana to the north and northwest South Dakota and Nebraska to the east Idaho to the west Utah to the southwest and Colorado to the south. Warren Edward Buffett ˈ b ʌ f ɪ t BUFF-itt. For 2021 and 2022 the Social Security tax is 62 of an employees income and the Medicare tax is 145.

The 25 Most Influential New Voices of Money. But note that the death benefit from a life insurance policy does not Inheritance tax. Born August 30 1930 is an American business magnate investor and philanthropist.

Bush he previously served as the 46th governor of Texas from 1995 to 2000. You will use the information from this notice to figure the amount of child tax credit to claim on your 2021 tax return or the amount of additional tax you must report on Schedule 2 Form 1040. This replaced Indianas prior law enacted in 2012 which phased out Indianas inheritance tax over nine years beginning in 2013 and ending on December 31 2021 and increased the inheritance tax exemption amounts retroactive to January 1 2012.

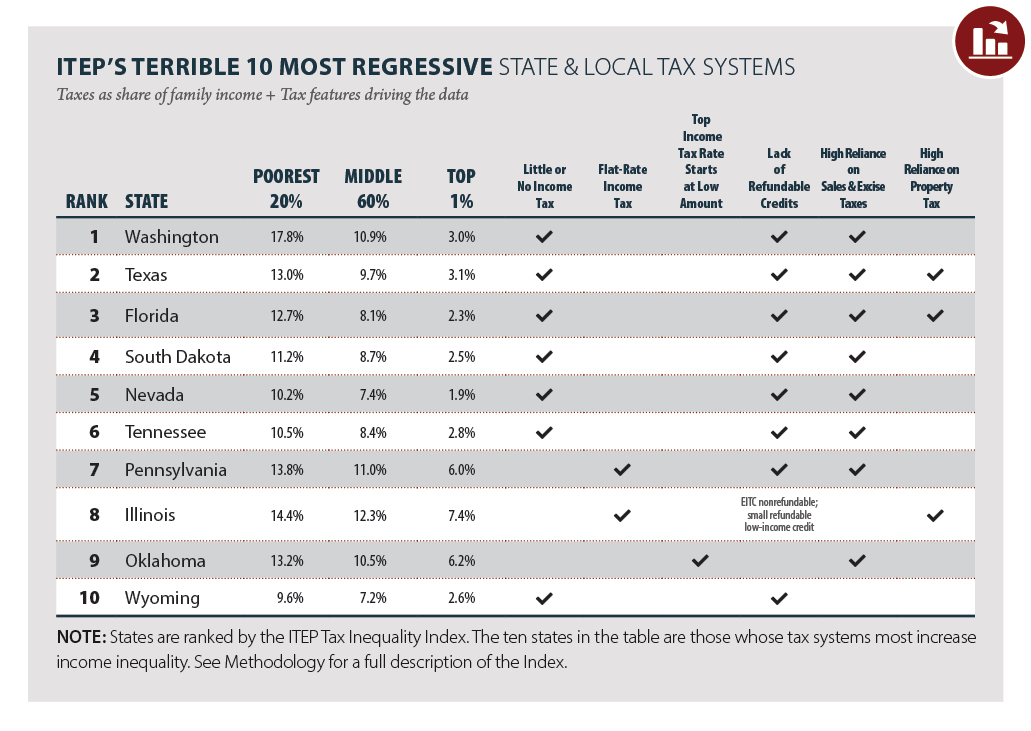

Twelve states and Washington DC. The Constitution of the United Kingdom or British constitution comprises the written and unwritten arrangements that establish the United Kingdom of Great Britain and Northern Ireland as a political body. If you have questions about how the health reform law will affect you and your insurance options please go to HealthCaregov or contact their Help Center at 1-800-318-2596 if you have questions.

Texas does not have an inheritance or. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the baseline rates until 2025 when the tax will be fully eliminated. A member of the Republican Party Bush family and son of the 41st president George H.

Психология развития личности для мужчин и женщин людей. Pick-up tax is tied to federal state death tax credit. For the 2021 tax year Oregons standard deduction allows taxpayers to reduce their taxable income by 2350 for single filers 4700 for those married filing jointly 3780 for heads of.

Ignoring tax someone wishing to work for a year and then relax for a year on the same living standard needs to save 50 of pay. Maryland is the only state to impose both. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

IA ST 4512. Similarly someone wishing to work from age 25 to 55 and be retired for 30 years till 85 needs to save 50 of pay if government and employment pensions are not a factor and if it is considered appropriate to assume a. George Walker Bush born July 6 1946 is an American politician who served as the 43rd president of the United States from 2001 to 2009.

Libertas freedom is a political philosophy that upholds liberty as a core value. Arizona transitioned from a four-bracket individual income tax with a top rate of 45 percent to a two-bracket system with a top rate of 298 percent a waypoint on the states transition to a 25 percent single-rate tax. With a population of 576851 in the 2020 United States census Wyoming is the least populous state despite being.

He is currently the chairman and CEO of Berkshire HathawayHe is one of the most successful investors in the world and has a net worth of over 95 billion as of October 2022 making him the worlds sixth-wealthiest person. Your guide to the future of financial advice and connection. Explore the list and hear their stories.

Unlike in most countries no attempt has been made to codify such arrangements into a single document thus it is known as an uncodified constitution. Libertarians seek to maximize autonomy and political freedom and minimize the states encroachment on and violations of individual liberties. If you received advance child tax credit payments during 2021 you will receive Letter 6419.

Keep this notice for your records. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. The postWorld War II economic expansion also known as the postwar economic boom or the Golden Age of Capitalism was a broad period of worldwide economic expansion beginning after World War II and ending with the 19731975 recession.

Employers also contribute an equal amount of FICA tax for each employee. On February 22 2021 Mazars provided millions of pages of Donald Trumps financial documents to the Manhattan District Attorney including his tax returns from January 2011 to August 2019. Provide AmericanBritish pronunciation kinds of dictionaries plenty of Thesaurus preferred dictionary setting option advanced search function and Wordbook.

The franchise tax rate ranges from 331 to 75 on gross revenue for tax years 2020 and 2021. Improving Lives Through Smart Tax Policy.

State Taxes On Capital Gains Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return

Estate Tax Returns Estate Planning Estate Settlement The American College Of Trust And Estate Counsel

Talking Taxes An Educational Discussion Of The Estate Tax The Gift Tax And The Capital Gains Tax By A Texas A M Expert

Texas Estate Planning Around 2022 Tax Exemptions Houston Estate Planning And Elder Law Attorney Blog November 23 2021

Property Taxes By State How High Are Property Taxes In Your State

Top Ten Reasons The U S House Will Kill The Death Tax

Estate And Inheritance Taxes Urban Institute

Texas Inheritance Laws What You Should Know Smartasset

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Is There An Inheritance Tax In Texas

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

How Do State Estate And Inheritance Taxes Work Tax Policy Center

A Guide To The Federal Estate Tax For 2022 Smartasset

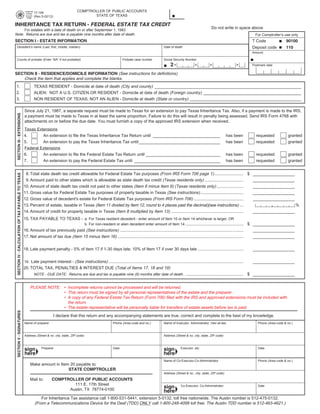

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

:max_bytes(150000):strip_icc()/inheritance_tax-185234580-58bc7c225f9b58af5c8df46c.jpg)